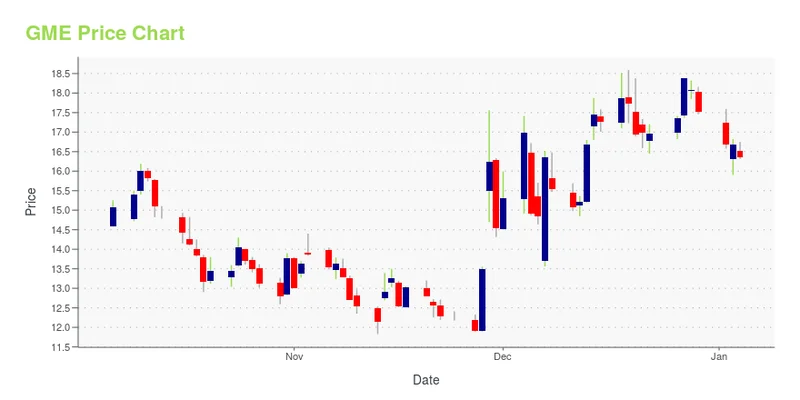

It’s easy to get lost in the noise of GameStop. You see the stock chart, a jagged line of hope and panic, and you think you understand the story. You see headlines about a meme-stock rally, the return of a folk hero trader named Roaring Kitty (GameStop (GME) Stock: The Meme King Returns as Roaring Kitty Drops $115M Bombshell), and a battle between Reddit and Wall Street. And you might be tempted to dismiss it all as just another round of casino capitalism, a digital spectacle with no real substance.

But what if that’s the wrong story? What if, beneath the chaos of the `gme stock price` and the speculative frenzy, something far more profound is being built? I’ve been watching this unfold, and I’m convinced we’re not witnessing a sequel to the 2021 short squeeze. We are witnessing the beta test of a new kind of corporation—one powered not just by capital, but by community.

When I first dug into the company’s recent financials, I honestly just sat back in my chair, speechless. Forget the memes for a second. This is a company that was left for dead, and it just posted a Q2 net income of $168 million on nearly a billion dollars in revenue, crushing expectations. It’s sitting on a fortress of $8.7 billion in cash and holds over $500 million in `Bitcoin` in its treasury. This isn't the balance sheet of a dying mall retailer; it's the war chest of a company quietly reinventing itself from the inside out.

The most fascinating part of this story isn’t just the financial turnaround. It’s how the company is interacting with its shareholders. In early October, GameStop did something unusual. It executed an 11-for-10 stock split and, more importantly, distributed special `gme warrants` to its investors.

Now, a warrant is essentially a long-term coupon that gives you the right to buy a share at a fixed price in the future. In this case, the strike price is $32. On the surface, it’s a clever way to potentially raise capital down the road without immediately diluting shareholders. But look deeper. This isn't just financial engineering; it's a message. It’s a reward for long-term belief. The company is telling its army of retail investors, "If you help us get the price back up here, you will be rewarded for your loyalty."

This is a paradigm shift. Traditional companies communicate with investors through sterile quarterly calls and SEC filings. GameStop is communicating through game mechanics. It has turned stock ownership into a collaborative quest, with clear objectives and rewards. The `gme reddit` forums lit up, not with confusion, but with theories of "4D chess"—seeing the move as a strategic trap for short sellers and a vote of confidence in the faithful. One user on Superstonk put it perfectly, arguing the warrants could "eliminate the need for a dilutive offering during any short squeeze and add buy pressure when converted."

This is the kind of breakthrough that reminds me why I got into this field in the first place. We are watching a company leverage its most unique asset: a decentralized, digitally native, and fiercely loyal shareholder base. How do you even begin to model that on a traditional Wall Street spreadsheet? What’s the P/E ratio for collective belief?

Of course, belief alone doesn’t pay the bills. But GameStop is building a real, tangible business on top of this foundation of community passion. The pivot to high-margin collectibles is brilliant. By coordinating exclusive Pokémon TCG drops (GameStop’s Wild October: Pokémon Gambit, Meme Traders, and a New GME Stock Rally) and becoming a hub for geek culture, they are transforming their physical stores from liabilities into assets—community gathering places you can't replicate online. You can almost feel the buzz in those stores during a limited release, the shared excitement of fans getting their hands on a rare card set. That’s a moat Amazon can’t cross.

This whole movement feels analogous to the early days of the open-source movement. Back then, corporate giants couldn't understand how a decentralized network of passionate volunteers could build something as robust and world-changing as Linux. They dismissed it as a hobbyist's project, lacking the structure and resources of a proper corporation. They were wrong. They failed to grasp the exponential power of a community united by a shared purpose.

GameStop is tapping into that same energy—the convergence of a profitable core business, a massive cash reserve, a forward-looking embrace of digital assets like `Bitcoin`, and a global community of millions of advocates is just staggering—it means the gap between the company of yesterday and the platform of tomorrow is closing faster than we can even comprehend. This isn't just a turnaround story. It's the blueprint for a "Community-Capitalism" model, where the line between customer, investor, and fan completely dissolves.

Naturally, Wall Street is skeptical. The consensus analyst rating is a "Sell," with a price target of $13.50 that seems anchored in a reality that no longer exists. But analysts are using old maps to navigate a new world. Their models are built for predictable, top-down corporations, not for dynamic, community-driven ecosystems. And that brings us to the one crucial point of caution: with this new power comes immense responsibility. GameStop is no longer just a company; it is the custodian of the hopes and savings of millions of people. It must wield that power with transparency and a deep sense of duty to the very community that gave it a second life.

Forget the daily stock price. What we are seeing with GameStop is far more significant. We are watching a live experiment in corporate evolution, a case study in how a company can harness the power of a decentralized community and turn it into a formidable strategic advantage. The old guard may not understand it, but this is what the future of brand loyalty and shareholder engagement looks like. The real question isn't whether GME will "squeeze" again. The real question is, who will be the next to follow this blueprint?