I’ve been watching the chatter around Marathon Digital (MARA) this week, and it feels like standing in the middle of a hurricane. One moment, you see headlines like MARA Stock Charts Cup-And-Handle Breakout As Marathon Digital Mines 736 Bitcoin In September, which point to a soaring Bitcoin treasury and solid production numbers. The next, a different ticker flashes red: the stock is down nearly 8%, rumors of insider trading are swirling, and analysts are pointing to shaky financials and liquidity concerns.

It’s chaos. It’s confusing. And if you’re looking at this through the lens of a traditional stock trader, it’s probably terrifying. You’re seeing a company whose stock price seems completely untethered from its own operational news. One day it's a rocket ship, the next it’s a falling stone.

But I think looking at it that way is a fundamental mistake. We’re not just watching a stock. We’re watching a proxy battle for the future of finance itself, played out in real-time on the NASDAQ. This isn't just about one company; it's about our collective, messy, and utterly fascinating transition into a decentralized world. What does that future look like? And can we really use the old maps to navigate this new territory?

Let’s be clear: Marathon Digital is a fascinating case study. On one hand, the company is doing exactly what it’s supposed to do. In September, it mined 736 Bitcoin. Its treasury swelled to over 52,000 BTC, making it one of the largest corporate holders on the planet. These are the fundamentals of the business—the digital equivalent of a gold miner pulling more and more ounces out of the ground. When I saw those production numbers, I felt that familiar spark—this is the kind of tangible progress that reminds me why I got into this field in the first place. It's real, digital creation.

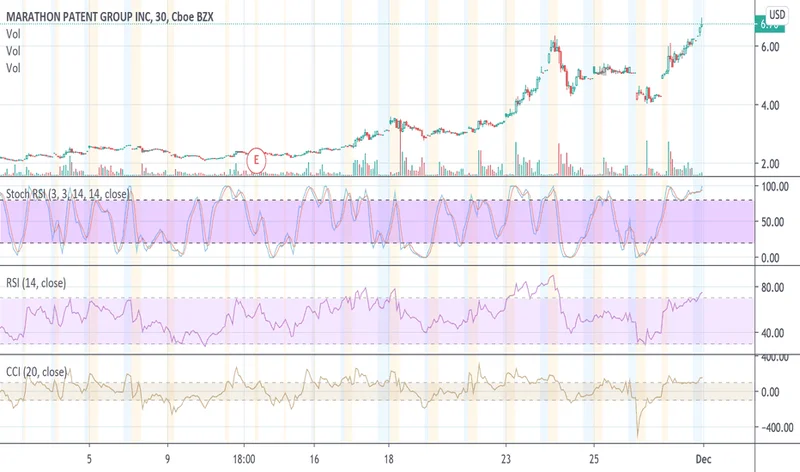

Then, you have the other side of the coin. The market’s reaction. The stock price whipsaws from a high of $22 down to $18 in a week. We hear whispers of insider trading and see reports highlighting a strange financial picture: an astronomical EBIT margin of 157% sitting next to negligible long-term revenue growth and a current ratio that signals potential liquidity issues.

So, what’s going on? It’s like watching a physicist and a philosopher argue over the nature of a photon. The physicist points to the math—the production, the treasury, the rising moving averages—and says, “It’s a particle, look at the data!” The philosopher points to the market panic, the human emotion, the regulatory uncertainty—and says, “No, it’s a wave of sentiment, just feel the vibration!”

They’re both right.

MARA has become a vessel for two completely different belief systems. One is the old-world view, which judges a company based on quarterly earnings reports, P/E ratios, and predictable revenue streams. The other is a new-world view, which sees the company’s value as inextricably linked to the success of a global, decentralized monetary network. The stock’s volatility isn’t a bug; it’s a feature of this collision. It’s the friction point between an industrial-age financial system and a digital-age one. Are we really surprised it’s generating so much heat?

Years from now, I believe we’ll look back at this period of extreme volatility in crypto-related equities and see it for what it was: a distraction. It reminds me so much of the dot-com bubble in the late 90s. People were obsessed with the stock prices of companies like Pets.com or Webvan. They soared to insane valuations and then crashed into oblivion, leading many to declare the entire internet a failed experiment.

They were focused on the wrong thing. They were watching the individual trees while completely missing the forest. The real story wasn't the stock price of a single company; it was the fact that humanity was laying down the foundational rails for a new global communication network. The internet was the revolution, not the stock tickers.

That’s what I see happening here. The day-to-day price of MARA is the noise. The signal is the relentless, programmatic, and unstoppable growth of the Bitcoin network itself. Marathon’s growing treasury isn’t just a number on a balance sheet; it’s a stake in a new financial ecosystem. This isn't just about a stock ticker it's about a fundamental rewiring of value and trust and ownership on a global scale and people are still trying to measure it with last century's yardsticks.

When you zoom out, the short-term panic over a 7% drop seems almost quaint. The bigger questions are the ones we should be asking. What does it mean for a publicly traded company to hold a significant portion of its value in a decentralized, censorship-resistant asset? How do traditional valuation models even begin to account for a future where Bitcoin is a global reserve asset, as some analysts are now forecasting with targets of $135,000?

Of course, this journey comes with immense responsibility. As we build this new system, we have to be vigilant not to simply recreate the inequities and centralization of the old one. The promise of decentralization is a more level playing field, but that's a future we have to actively build, not one that's guaranteed. The rumors and fear swirling around companies like MARA are a potent reminder that human behavior doesn't change overnight, even when the technology does.

So, when people ask me if MARA is a buy or a sell, I tell them they're asking the wrong question. It’s not about timing the market; it’s about understanding the shift. The volatility, the fear, the wild optimism—this is what a paradigm shift feels like from the inside. It’s messy, unpredictable, and utterly exhilarating. You can either stand on the sidelines and wait for the dust to settle, or you can try to look through the noise and see the new world being built, one block at a time. I know where I’m looking.