The IRS announces new federal income tax brackets for 2026, and the usual suspects in the financial media are dutifully reporting it as "relief for millions."

Give me a break.

This isn't relief. This is the bare minimum. This is the institutional equivalent of a landlord repainting the water-stained patch on your ceiling and calling it a "luxury renovation." They’re not giving you a gift; they’re just adjusting the math so the inflation they helped create doesn't completely push your pathetic cost-of-living raise into a higher tax bracket.

It’s an annual performance, a carefully choreographed piece of political theater designed to make you feel like the system is working for you. Spoiler: it isn't.

They call it "bracket creep." It's a term that sounds like a B-movie monster but is actually far more mundane and insidious. It's what happens when your pay goes up by 3% to match inflation, but the tax brackets don't move. Suddenly, your "raise" gets eaten alive because you've been bumped into a higher tax tier, even though you can't actually afford to buy anything more than you could last year.

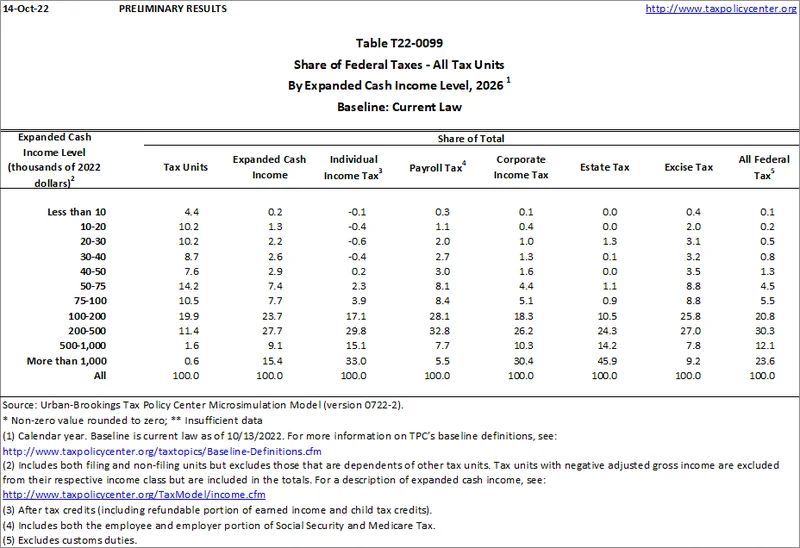

So, the IRS "adjusts for inflation." They nudge the income thresholds up by a few percentage points. A single person making $50,000 might see their top marginal rate drop from 22% to 12% on a slice of their income. The headlines will scream "TAX CUT!" You'll see that tiny extra bit in your paycheck—maybe enough for an extra large coffee once a week—and feel a fleeting sense of victory.

This is a shell game. No, a shell game implies a chance of winning. This is more like a casino reprogramming a slot machine. They change the pictures on the wheels from cherries to lemons, adjust the payout on a three-lemon line by a nickel, and call it a brand-new game. The odds are still set by the house, and offcourse, the house always wins. They want you to be so focused on the new pictures and the shiny nickel that you forget the entire building is designed to take your money.

What real questions should we be asking here? How about this: Why is our tax system so ridiculously complex that a routine, algorithmic inflation adjustment is treated as front-page news? And is "preventing bracket creep" really the government's heroic act of the year, or is it just basic maintenance on a deeply flawed machine?

Let's get down to it. The top rate of 37% will now apply to individuals making over $640,600. I'm sure the guy pulling in $639,000 is breathing a huge sigh of relief. For everyone else, the changes are marginal at best.

The fact sheet mentions the "big, beautiful" tax and spending law, a Trump-era holdover, is responsible for some of this. They even threw in some goodies like a bigger senior deduction and tax breaks on tipped income. It all sounds great on paper. But this ain't a gift. It's a calculated anesthetic.

It reminds me of the nightmare of filing my own freelance taxes every year. I spend days sorting through 1099s and receipts for office supplies that are really just pens I bought at Target, all to figure out how much of my own money I have to hand over. Do I care that the threshold for the 22% bracket moved by a couple thousand dollars? Honestly... it feels like arguing over the seating arrangement on a sinking ship. The ship is still going down.

This is the fundamental problem. The system is designed to be confusing. It's built to make you feel grateful for scraps. They want you to focus on the percentage points, the minor shifts, because if you looked at the whole system and how it favors capital over labor, corporations over individuals, and the wealthy over everyone else, you might actually get angry.

Then again, maybe I'm the crazy one here. Maybe that extra $15 a month really is a game-changer for some people. But I doubt it covers the increase in their grocery bill.

Don't let the headlines fool you. You didn't get a tax cut. You just got a slightly-less-unfair tax calculation. This annual adjustment is nothing more than a software patch for a buggy operating system. It fixes one minor glitch while ignoring the dozens of critical vulnerabilities that are slowing the whole thing down to a crawl. The real problems—stagnant wages, a tax code with more loopholes than a block of Swiss cheese, and an economy that feels permanently tilted against the working person—remain completely untouched. This is noise. A mathematical sedative to keep you from asking for real, structural change. Enjoy your extra coffee.