At first glance, the announcement reads like a standard piece of business from the pharma world. Novo Nordisk, the Danish behemoth swimming in GLP-1 cash, has agreed to acquire Akero Therapeutics, a clinical-stage biotech (Akero Therapeutics to be Acquired by Novo Nordisk for up to $5.2 Billion). The headline number is a substantial $5.2 billion. It’s the kind of deal that makes investors nod, analysts update their models, and the rest of the industry take note.

But the real story here isn’t the total sticker price. It’s not about another big company getting bigger. The story is buried in the fine print, in the structure of the deal itself. This isn’t a straightforward purchase; it’s a meticulously crafted, half-billion-dollar bet on a single, high-stakes clinical outcome. To understand this acquisition, you have to ignore the headline and focus on the asterisk.

The terms laid out are clear: Akero shareholders will receive $54 per share in cash upfront. That part is simple, representing an immediate equity value of approximately $4.7 billion. The remaining value, however, is a ghost. It’s a non-transferable Contingent Value Right (CVR) worth $6 per share, payable only if Akero’s lead drug, efruxifermin (EFX), achieves a very specific goal.

This CVR isn’t just a kicker. It’s a financial instrument that precisely quantifies Novo Nordisk’s assessment of clinical risk. That $6 per share, totaling roughly half a billion dollars, is the price of uncertainty. It’s a masterclass in hedging a biotech acquisition, separating the tangible value from the aspirational.

Let’s break down the numbers. The upfront cash portion represents a 42% premium to Akero’s stock price before market speculation began swirling in May 2025. That’s a solid, respectable premium that ensures shareholder approval and rewards the company for its progress to date. It’s the price for getting EFX and its promising Phase 3 program into Novo’s formidable pipeline. Novo is essentially paying for a very strong shot on goal.

But the deal’s total potential value, the one that makes the headlines, includes that CVR. If the CVR pays out, the total premium jumps to 57%. That’s the difference between a good deal and a great one for Akero’s investors. And this is the part of the deal structure that I find genuinely compelling. Novo is telling the market, and Akero’s shareholders, exactly what they believe the highest-risk part of the asset is worth.

A CVR is a common tool in biotech M&A, but the trigger for this one is surgically precise. The payment is contingent upon full U.S. regulatory approval of EFX for the treatment of compensated cirrhosis due to MASH by June 30, 2031. This isn’t a vague "upon FDA approval" clause. It’s a specific indication, with a specific deadline six years down the road.

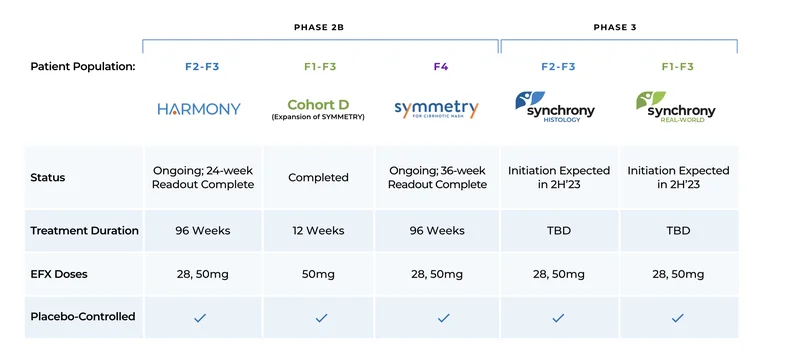

This structure allows Novo to de-risk the acquisition substantially. They are paying for the high probability that EFX will be a successful treatment for MASH (metabolic dysfunction-associated steatohepatitis) in patients with earlier-stage liver scarring (F2-F3 fibrosis). The data from Phase 2 trials like HARMONY supports this. But treating full-blown cirrhosis (F4 fibrosis) is a different beast entirely. It’s the holy grail of liver disease treatment, and it’s where countless other drugs have failed.

So, Novo is effectively bifurcating the asset. They’ve bought the core product for $4.7 billion. And they’ve placed a side bet, worth about half a billion dollars—or $522 million, to be more exact based on the implied share count—on whether Akero can hit a home run. What does this tell us about Novo’s internal forecasting? Does their model suggest the cirrhosis indication is an upside scenario rather than a base case, and they’ve priced that optionality at exactly $6 per share?

To appreciate the elegance of this CVR, one has to understand the MASH landscape. MASH is a silent epidemic, a severe form of fatty liver disease tied to obesity and diabetes that can lead to scarring, cirrhosis, and eventually liver failure or cancer. The market is enormous, but the biology is complex, and the regulatory path is littered with failures.

Getting a drug approved for MASH with F2-F3 fibrosis is a monumental achievement. But getting one approved to treat, and potentially reverse, compensated cirrhosis (where the liver is heavily scarred but still functioning) is the ultimate prize. It’s the difference between preventing the house from burning down and rebuilding a section that has already been charred. The CVR is like a buyer paying a fair price for a historic home, but holding back a final, substantial payment until an engineer certifies that the cracked foundation can actually be fully restored. It’s not a lack of faith; it’s a rational hedge against a low-probability, high-impact outcome.

This structure protects Novo Nordisk from overpaying for blue-sky potential. If EFX only succeeds in treating pre-cirrhotic MASH, Novo has still acquired a blockbuster-potential asset that fits perfectly with its GLP-1 franchise (drugs like Ozempic and Wegovy are often used by the same patient population). The deal would still be a strategic success. But if EFX achieves the near-miraculous and gets the cirrhosis indication, Akero shareholders get their bonus, and Novo secures a truly transformational therapy and market dominance.

The deadline of June 30, 2031, is also telling. It gives Akero’s ongoing SYNCHRONY Outcomes study, which is focused on this very patient group, ample time to play out, submit data to the FDA, and go through a full review cycle. The timeline is realistic, not rushed. It acknowledges the long, arduous road of clinical development. Novo isn’t just buying a drug; it’s buying a well-defined, multi-year clinical trial process, and it has structured the payment to align with that process’s most critical milestone. It’s a deal built on patience and data, not just optimism.

Ultimately, the Novo-Akero transaction is less of a blockbuster acquisition and more of a sophisticated financial instrument. It’s a deal that acknowledges the profound uncertainty of drug development and prices it accordingly. Novo Nordisk isn’t just buying a company; it’s buying a probability distribution of clinical outcomes. They’ve paid a premium for the most likely scenarios and created a defined, capped payment for the most optimistic one. For Akero, it provides a strong, certain return for their work thus far while allowing them to share in the ultimate success they’ve been chasing. It’s a clean, logical, and refreshingly honest approach to valuing the future. In a world of hype and hope, this deal is a testament to the cold, hard, beautiful logic of the numbers.