So GameStop is issuing a “special dividend.” Let’s just stop right there. Whenever a company, especially this company, uses a word like “special,” you should immediately check your wallet. It’s corporate PR-speak for “we’ve cooked up a new, convoluted way to play with your money.”

This isn’t a dividend. A dividend is cash in your pocket, a thank you note from the company for owning a piece of it. This is a warrant. It’s a coupon. It’s a lottery ticket that the company is "gifting" you, which only becomes valuable if you give them more money later, assuming the stock somehow levitates above $32.

This whole warrant thing is just a bad deal. No, 'bad' is too simple—it's a masterclass in financial engineering designed to look like a gift while potentially flooding the market with new shares and diluting everyone who holds them. It’s a cash call, plain and simple, dressed up in a party hat.

I have to hand it to them. The timing is brilliant. They drop this "special dividend" news right when the market is high on their latest earnings report. Revenue surged 21.8% year-over-year! They swung from a $32 million loss to a $44.8 million profit! The meme-stock army is beating its chest, claiming victory.

But what fueled this miracle quarter? A Pokémon distribution event.

Let that sink in. Their big turnaround strategy, the thing that’s supposed to justify a stock price completely detached from reality, was handing out digital monsters. This isn't a business model; it's a sugar high. It’s like an aging rock band that can’t write new music, so they just keep playing their one hit from 1985 to a dwindling crowd at the state fair. The nostalgia is potent, sure, but what happens next quarter when there’s no Charizard to dangle in front of everyone? Are we really supposed to believe that this is the cornerstone of a sustainable, long-term recovery?

It feels like every corporate announcement these days is just a distraction. It's like my cable company sending me a glossy mailer about their "new and improved" channel lineup when all they really did was move ESPN to a different number and jack up my bill by five bucks. It's all just noise designed to obscure the simple truth.

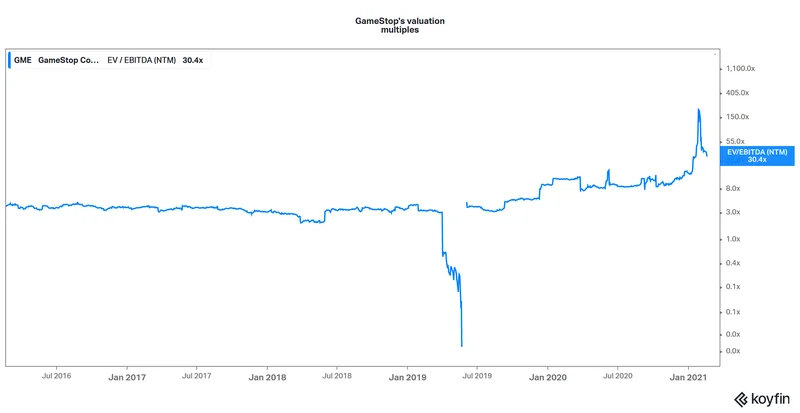

The numbers tell the real story. The retail narrative has the stock’s “fair value” pegged at an astronomical $120 a share. The stock is actually trading around $27. That’s not a valuation gap; that’s a chasm between faith and reality. Meanwhile, its price-to-earnings ratio is sitting at 33.6x, nearly double the industry average. You’re paying a premium for a company whose most recent success was… a Pokémon giveaway. Give me a break.

This entire saga stopped being about video games a long time ago. It’s about a story. A narrative. It's a crusade against hedge funds, a middle finger to Wall Street, a collective belief system that has taken on a life of its own. And the company is now leaning into it, hard. Adding Bitcoin to its balance sheet? Issuing these goofy warrants? These aren't the moves of a retailer trying to reinvent itself. These are the moves of a company that knows its primary product is no longer Funko Pops, but financial volatility.

They're selling a story of a comeback, a David vs. Goliath epic, and if you buy in, you're part of the movement. But at the end of the day...

The warrants are the perfect encapsulation of this. They don’t reward you for what the company has done; they ask you to bet on what it might do. They give the illusion of a bonus while setting the stage to raise up to $1.9 billion, which offcourse, will come directly from the pockets of the very shareholders they claim to be rewarding. Who exactly is getting the better end of this deal? It sure doesn't feel like the average retail trader who thinks they're getting a gift. Then again, maybe I'm the crazy one here. Maybe nostalgia and crypto are the future of retail.

I doubt it.