Generated Title: Hims & Hers: Is the Market Buying a Story or a Stock?

The market is a creature of narrative, but it's supposed to have a healthy respect for arithmetic. On October 2nd, it seemed to remember that. Hims & Hers Health announced that its Chief Operating Officer, Nader Kabbani, was vacating his position. The response, as one report explained Why Hims & Hers Stock Slipped Today, was swift and predictable. On a day the S&P 500 was essentially flat, HIMS stock was hit with a more than 9% sell-off.

This is textbook market logic. C-suite instability in a relatively young, high-growth company is a legitimate risk factor. A key operator stepping away, even into an "advisory role," introduces a variable. Investors, quite rationally, priced that new variable into the stock. For a brief moment, the `hims stock price` reflected a healthy dose of skepticism.

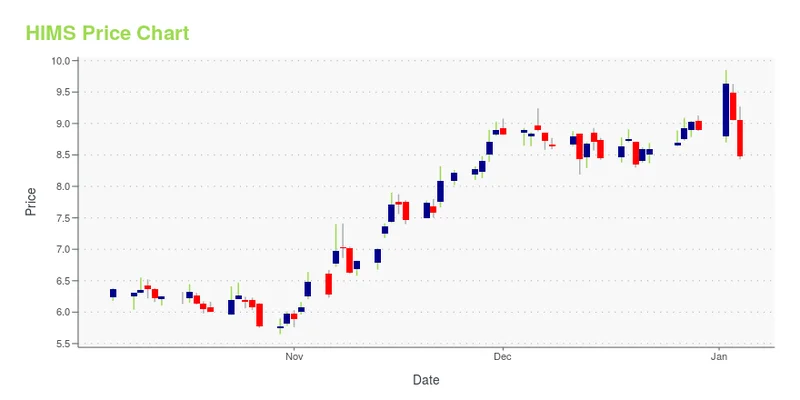

But the market’s memory is short, and its appetite for a good story is insatiable. That single day of rational re-pricing was quickly swallowed by a wave of bullish sentiment. In the month that followed, the stock didn't just recover; it surged. We saw a jump of about 40%—to be more exact, 39% in the past month alone. This is the central paradox of Hims & Hers right now: a company whose operational stability was questioned one week is being valued for spectacular, uninterrupted growth the next. Which is it? Is the market seeing a fundamental strength that outweighs the C-suite shuffle, or is it just ignoring the warning signs?

To understand the current valuation of Hims & Hers, you have to separate the narrative from the numbers. The narrative is powerful, and frankly, it’s a good one. Hims is building a vertically integrated healthcare platform that bypasses the sclerotic, byzantine American insurance system. It aims to handle diagnosis, treatment, and fulfillment under one digital roof, personalizing care at scale. This story promises faster growth, higher margins, and a direct relationship with the consumer. It’s the kind of disruption that gets investors excited, and it’s the engine behind the most bullish analyses, which peg the company’s fair value as high as $86 a share.

I’ve seen this script before with stocks like `sofi stock` or `pltr stock`, where a compelling vision of the future can temporarily decouple a stock from its present-day financials. The market isn't buying the company as it exists today; it's buying a five-year projection of its most optimistic future. The problem arises when you put that seductive narrative next to the cold, hard data from the ledger.

This is where the story starts to fray. According to one analysis that asks OMCL or HIMS: Which Is the Better Value Stock Right Now?, Hims & Hers sports a Value grade of D. Let's look under the hood to see why. The company trades at a price-to-earnings (P/E) ratio of 67.6x, which is a significant premium over the U.S. Healthcare industry average of 21.4x. Even more telling is the forward P/E, which sits at a lofty 94.83. By comparison, a peer like Omnicell (OMCL) has a forward P/E of 20.30.

And this is the part of the report that I find genuinely puzzling: the Price-to-Book (P/B) ratio is 22.76. A P/B ratio compares the market value to the company's book value (assets minus liabilities). A ratio this high suggests the market is valuing intangible assets—brand recognition, platform technology, future growth prospects—at an astronomical premium relative to its tangible assets. For a pure software company, this might be explainable. But for a business that relies on managing physical supply chains for pharmaceuticals and coordinating with a medical professionals, a P/B of this magnitude is an outlier that demands extreme scrutiny. What, precisely, are these intangible assets that are worth 22 times the company's net tangible worth?

The valuation of Hims & Hers feels like a high-performance racing engine bolted onto the chassis of a family sedan. The engine—that powerful, disruptive narrative of vertically integrated, cash-pay healthcare—is capable of incredible acceleration. The market is pricing the stock as if that engine is already screaming down the track, winning the race.

But the chassis—the underlying fundamentals, the operational consistency, the C-suite stability—has to be able to handle that speed. The abrupt COO change is a wobble in the steering. The P/B ratio of 22.76 is a potential stress fracture in the frame. The forward P/E of 94.83 is the fuel consumption gauge, and it’s telling us this engine needs an incredible amount of high-octane growth just to keep running without stalling.

The new COO, Mike Chi, comes from a background in marketing and e-commerce (with stints at Zola and Intermix). This might be a brilliant strategic pivot, signaling a doubling-down on brand and direct-to-consumer growth. Or, it could represent a shift away from the less glamorous, but arguably more critical, operational nuts and bolts that a company at this scale requires. We simply don’t have enough data to know. But the market seems to have already decided it’s the former.

This raises the critical questions that the bullish narrative glosses over. What level of flawless, multi-year execution is required to justify these multiples? Can the company sustain its growth trajectory without the operational leader who helped build it to this point? And is the market correctly pricing in the risk of regulatory scrutiny, particularly around compounding practices, which could throw a wrench into the entire machine?

Investors are paying a premium for a perfect future. The current `hims stock news` cycle is focused on the growth, but the risks haven't disappeared. They've just been drowned out by the roar of the engine.

Ultimately, the chasm between the two views of Hims & Hers comes down to this: one side is analyzing a business, and the other is buying a story. The business has a sky-high valuation that is difficult to justify with current fundamentals and has just demonstrated a degree of C-suite instability. The story, however, is about reshaping a multi-trillion-dollar industry, and if it succeeds, today's price might look cheap in hindsight.

My analysis suggests the current stock price is not a reflection of the company's current state, or even its likely state in 12 months. It is a bet—a highly leveraged one—on a very specific, very optimistic outcome five to ten years down the line. It's a bet that the engine won't falter, the chassis won't crack, and the road ahead will be perfectly smooth. That's a lot to ask, and the numbers are telling us the margin for error is razor-thin.