For a few weeks in the autumn of 2025, it felt like we were watching the future unfold in fast-forward. The project was ChainOpera AI ($COAI), and it wasn’t just another token on the charts; it was a signal, a flash of lightning that illuminated a new path for integrating artificial intelligence and Web3. Its rise was nothing short of breathtaking. A Fully Diluted Valuation soaring past $4 billion, a tidal wave of listings on every exchange that mattered, and trading volumes that briefly eclipsed giants like Solana and BNB.

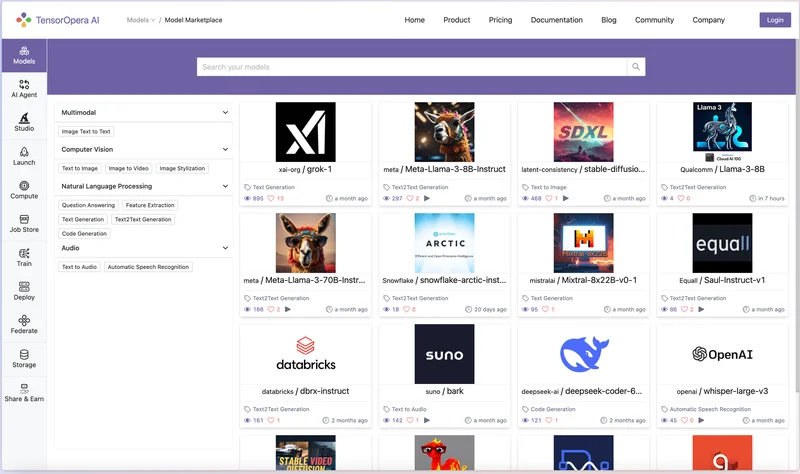

When I first saw the project’s dashboard and the sheer number of active users—3 million people interacting with its AI, 300,000 of them paying with BNB—I honestly just sat back in my chair, speechless. This is the kind of breakthrough that reminds me why I got into this field in the first place. It wasn't just speculation; it was adoption. For years, we’ve talked about the promise of Web3, but we’ve been stuck in a frustrating loop. We had products with no users, and tokens with no products. The two worlds were galaxies apart. ChainOpera seemed to have finally built the bridge.

What they created was a "user-to-holder funnel"—in simpler terms, they figured out how to turn the people who loved and used their AI tools into people who had a real, tangible stake in the network's success. It’s a paradigm shift. Imagine if every time you used Google Search, you earned a tiny fraction of a share in Alphabet. That’s the kind of revolutionary alignment of incentives we’re talking about here. And it worked. 40,000 of their product users became active $COAI holders. It was the blueprint we’d all been waiting for.

Of course, ChainOpera AI didn't happen in a vacuum. Its launch was a masterclass in strategic timing, a convergence of forces that created a perfect storm of growth. They launched into the heart of a raging crypto bull run, riding the powerful tailwinds of Bitcoin hitting new all-time highs. They built on the BNB Smart Chain just as it was experiencing an unprecedented surge in activity, becoming the most active blockchain on the planet. It was this incredible confluence of a genuinely useful product, a massive built-in user base from the Binance ecosystem, and a market absolutely roaring with capital that sent it parabolic—it was the kind of explosive growth that makes you realize the old rules just don't apply anymore and we're writing a new playbook in real-time.

The project became a focal point for the market's excitement. The simultaneous listing with another hot project created a traffic resonance effect, a feedback loop of hype and volume that pushed its single-day perps trading over $6 billion. Critics, of course, were quick to point out the risks. I saw the warnings on X: "The top 10 wallets hold 96%... it's pure manipulation." And from a purely financial, risk-averse perspective, you can understand the caution. Concentrated holdings are a legitimate red flag in any nascent project.

But what that narrow view missed was the tectonic shift happening underneath. Was the price in early October a speculative bubble? Absolutely. But was the project itself just smoke and mirrors? Not at all. It was a functioning, widely-used AI ecosystem that had achieved something most Web3 projects only dream of: product-market fit. The question wasn't whether the price was sustainable—no parabolic move ever is. The real question was whether the model was sound. Could this new way of building a community-owned network survive?

And then, on October 11th, we got our answer in the most brutal way imaginable.

The crash was catastrophic. A single geopolitical announcement—a threat of 100% tariffs—sent the entire global market into a nosedive. Bitcoin plunged, $560 billion was wiped from the crypto market cap, and over $19 billion in leveraged positions were liquidated. It was a bloodbath. Projects, good and bad, were dragged down in the chaos. ChainOpera AI, with its high FDV and low initial float, was hit hard like so many others.

In moments like that, it's easy to declare the whole experiment a failure. To throw up your hands and say, "See? It was all just a house of cards." But that’s a failure of imagination. Every great technological revolution has its moment of reckoning. The dot-com crash in 2000 wasn't the end of the internet; it was the end of the hype about the internet. It was a great filter that wiped out the Pets.coms of the world but left behind the foundational, world-changing companies like Amazon and Google.

That’s how I see the crash of October 2025. It was a violent, painful, but ultimately necessary market correction. It washed away the speculative froth and forced everyone to ask a fundamental question: When the tide goes out, what’s actually left on the shore? What projects have real technology, real users, and a real reason to exist beyond a number on a screen?

The price of $COAI was a casualty of a macro-economic panic, an event completely disconnected from its own ecosystem's health. But the blueprint it established? The 3 million users? The proof that you can convert users into owners? That survived. The financial storm can’t erase a technological and social breakthrough. It can’t un-invent a better model for building the next generation of the internet.

Let's be perfectly clear. The financial story of ChainOpera AI in October 2025 is a cautionary tale about market volatility and speculative frenzy. But the technological story is an inspiring chapter in the book of what's next. The crash didn't invalidate the model; it stress-tested it. It proved that even when global markets are collapsing, the things that truly matter—utility, community, and genuine innovation—are what endure. The price is just noise; the blueprint is the signal. And that signal is clearer now than ever before.