You just can’t make this stuff up.

On the very same day Microsoft rolls out the Brinks truck to announce it made a staggering $77.7 billion in a single quarter, its crown jewel, the mighty Azure cloud, decides to take a nap. Xbox goes down. Office 365 goes down. The digital backbone of countless companies worldwide just… breaks. I can just picture the frantic IT guys in some suburban office park, coffee spilling on their keyboards as they stare at error screens, while somewhere in Redmond, executives are popping champagne.

The timing is so perfect, it’s almost poetic. It’s a beautiful, crystalline moment of pure, unadulterated tech industry hypocrisy.

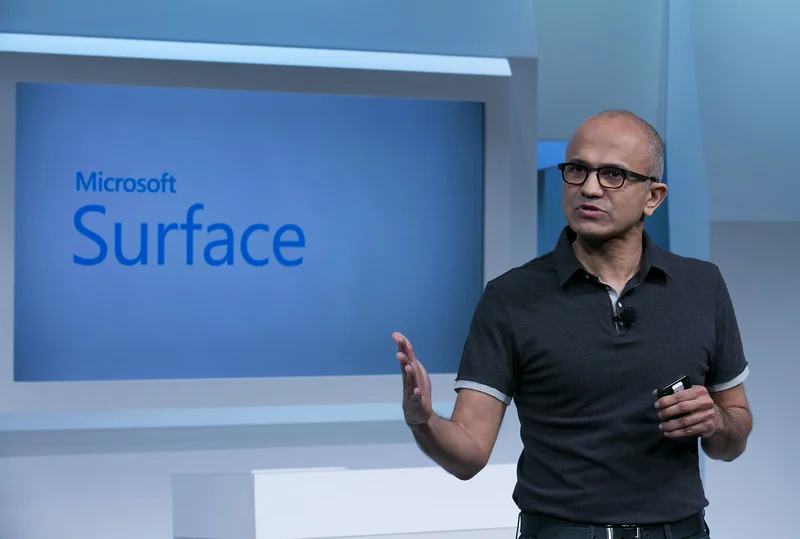

CEO Satya Nadella gets on the horn and talks about a “planet-scale cloud and AI factory.” Let me translate that for you from corporate-speak into English: “We’ve built a Jenga tower of servers so massive and complex that not even we understand how it works anymore, but boy is it making us rich.” This isn't a factory; it's a casino, and the house is printing its own chips. How can your "planet-scale" anything be so fragile that it crumbles on the day you're meant to be taking a victory lap?

Let's look at the numbers, because they're insane. They beat expectations on revenue and profit. Azure growth is up 40%. Their net income was nearly $28 billion. The numbers are impressive. No, 'impressive' is the wrong word—they're obscene. This is the kind of money that used to be reserved for small nations, not a company that sells spreadsheet software and video game consoles. And Wall Street eats it up, pushing the company’s value past $4 trillion.

This all comes on the heels of them tightening their grip on OpenAI, turning the once-idealistic “non-profit” into their own private AI engine with a new 27% stake. They’re not just building the infrastructure; they’re buying up the brains, too.

But the outage is the tell. It’s the single thread you pull that makes you question the whole sweater. We’re being sold a vision of an AI-powered future running on flawless, intelligent, infinitely scalable cloud architecture. Yet on a random Wednesday, that architecture proves it’s just as vulnerable as my home Wi-Fi when my neighbor starts streaming three football games at once. What happens when our entire economy, our healthcare, our logistics, is fully dependent on this stuff and it decides to go offline for a few hours? Or a few days?

Are we building the future on a foundation of sand? And is anyone in charge actually double-checking the concrete mix, or are they all too busy counting their money?

Here’s the part that really gets me. Microsoft spent almost $35 billion—in three months—on AI projects. That's a 74% increase from last year. CFO Amy Hood tried to calm the bubble-fearing investors by saying this spending is to meet demand that’s already “booked.” This is the corporate equivalent of saying, “Don’t worry, we’re not crazy. We’ve already taken everyone’s money for the rollercoaster we haven’t finished building yet.”

She admits they’ve been short on capacity for quarters. She thought they were going to catch up, but demand is just too high. When you see these demand signals, she says, "we need to spend." Offcourse you do.

And while they’re spending at a rate that would make a pharaoh blush, they also announced plans to cut 9,000 jobs. This ain't unique to them; Amazon is reportedly axing up to 30,000 corporate gigs. The subtext is clear: we have endless money for silicon, but the budget for humans is shrinking. They’re building a world where managers have to justify hiring a person with pesky needs like health insurance over an AI that just needs electricity and a software update. Then again, maybe I'm the crazy one for thinking that people should still be part of the equation.

This whole AI arms race feels like a mania. A gold rush where everyone is pouring billions into digging holes in the ground, hoping to strike it rich, and they expect us to just nod along and buy more stock...

It’s a frenzy. Nvidia is worth $5 trillion. The “Magnificent Seven” are pumping hundreds of billions into data centers. But bubbles, as the wise folks say, are only visible right after they pop. And this one is getting awfully big and shiny.

Let’s be honest with ourselves for a minute. The whole spectacle is a charade. We have a company reporting nation-state-level profits, fueled by a technological revolution that promises to change humanity, running on infrastructure that can’t even stay online through its own earnings call. It’s a perfect metaphor for the entire tech industry right now: a glittering, impossibly valuable machine that is, at its core, deeply, fundamentally, and terrifyingly fragile. And we're all strapped in for the ride.