Starbucks’ Earnings Call Was a Masterclass in Misdirection

*

By Julian Vance

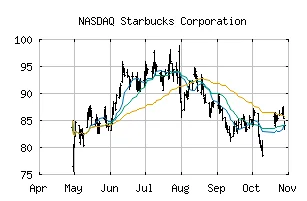

On October 29th, Starbucks reported its fiscal fourth-quarter earnings (Live: Complete Starbucks (SBUX) Earnings Coverage), and the headline numbers were precisely as bleak as anticipated. Normalized EPS for the quarter came in at $0.55, a precipitous drop of nearly 31%—30.9% to be exact—year-over-year. U.S. comparable store sales were down, transactions were down, and operating margins had been squeezed by over 600 basis points.

Faced with this data, management did what any embattled leadership team would do: they told a story. It’s a compelling one, full of cozy "espresso bars," renewed customer connections, and a grand vision of returning the company to its roots as a "third place." It’s a narrative designed to soothe investors, to draw their attention to the freshly polished wood and away from the cracks forming in the foundation. But when you set the story aside and look at the numbers, a different picture emerges. The earnings call wasn't a report on a business; it was a masterclass in misdirection.

The centerpiece of Starbucks' turnaround narrative is the "Sit & Savor" plan. The idea is to "uplift" stores with small-scale renovations, creating cozier, more inviting spaces where customers will want to linger. A company representative put the best possible spin on it, claiming early results show customers are "staying longer, visiting more often, and sharing positive feedback." The company is even making this "espresso bar" format the standard for future expansion.

On the surface, it sounds logical. The problem is, it runs completely contrary to observed customer behavior. Data from Placer.ai is unambiguous on this point: the share of customers staying longer than 10 minutes has been in a near-constant state of decline since November 2024. As Citi analyst Jon Tower correctly diagnosed, Starbucks has spent the better part of a decade training its customers to see the brand as a convenience channel. The mobile order, the drive-thru, the quick pickup—these are the pillars of the modern Starbucks experience. The company has optimized its entire operation for speed and throughput.

To now attempt a pivot back to a leisurely, sit-down model is like trying to turn a battleship in a bathtub. It's a fundamental misunderstanding of what their customers have been conditioned to value. The "uplifted" stores may indeed be "cozier," but are they solving the core business problem? Or are they just a high-visibility project to signal that something is being done? I've looked at hundreds of these corporate turnaround plans, and this particular strategy feels less like a data-driven initiative and more like a branding exercise. The capital being spent on these renovations might make for a good press release, but does it actually address the 9% cumulative traffic decline over the last two years? (“Showing Promise”: Starbucks Stock (NASDAQ:SBUX) Falters as the Sit & Savor Plan Disappoints)

While the market was being told a story about comfortable chairs and ambient lighting, the real drama was playing out in the expense lines of the P&L. This is where the narrative truly begins to fray. Oppenheimer analyst Brian Bittner laid out the case with clinical precision, noting that consensus EPS estimates for Starbucks had already fallen 37% over the past year, and the risk of further downward revisions was high.

The core of the issue is a dangerous disconnect between revenue assumptions and operating costs. The Street’s models for 2026, according to Bittner's analysis, assume a return to positive traffic growth while simultaneously underestimating the rise in per-store operating expenses. He projects these costs will grow at a mid-single-digit rate in 2026, driven by a necessary $500 million investment in labor, while consensus models are only baking in a 2.5% increase.

This isn't a minor discrepancy; it's a chasm. Bittner calculates that every 100 basis points of unexpected weekly opex growth shaves about 10 cents off the annual EPS. Management's solution, the "Green Apron Service" initiative (essentially, adding more labor hours to improve service speed), is a direct input into this cost pressure. They are trying to solve a traffic problem by spending more money, which puts even more strain on already compressed margins. They need to generate significantly higher sales just to stand still. Is it possible? Certainly. But is it probable, given the persistent price-value concerns and intensifying competition? The data suggests it's an uphill battle.

The entire recovery thesis hinges on a rebound in 2026, with analysts expecting an EPS jump of over 20%. But that rebound is predicated on assumptions that seem, at best, heroic. It assumes the "Green Apron" plan can reverse two years of traffic decline without crippling store-level profitability. It assumes customers will suddenly abandon years of grab-and-go habits to "savor" their coffee. It assumes a lot. And assumption, as any analyst knows, is the mother of all write-downs.

Look, I get it. No CEO wants to get on a quarterly call and say, "Our core U.S. business is slowing, our costs are rising faster than our sales, and we haven't yet figured out how to fix it." It's much easier to talk about "uplifted coffeehouses" and a "reimagined rewards program." But at the end of the day, the numbers don't lie. The story of Starbucks right now isn't about becoming a "third place" again. The real story is about a company grappling with a mature market, a flawed cost structure, and a customer base it may no longer fully understand. The cozy new interiors are just a distraction from the cold, hard math.