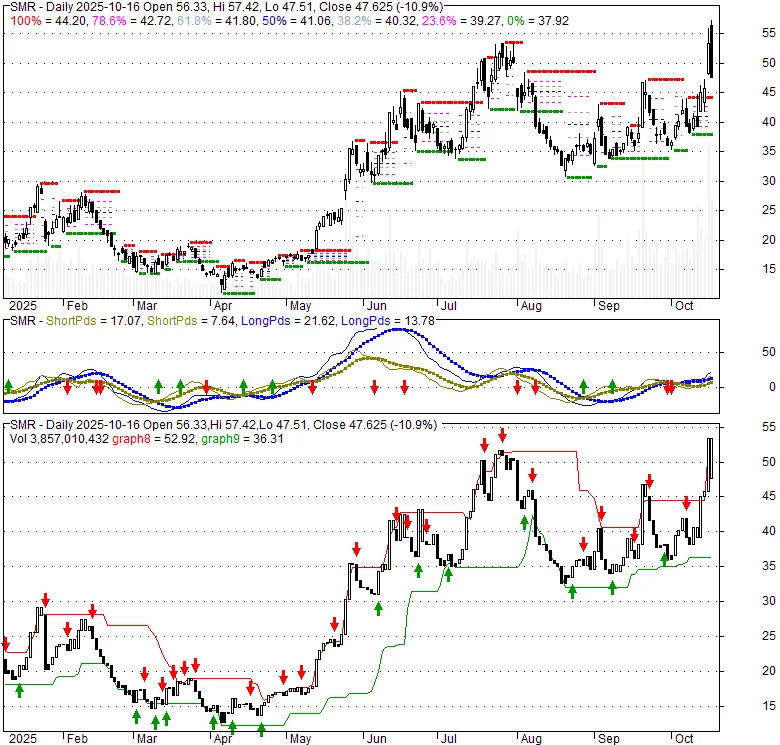

The market action in NuScale Power (SMR) this past week has been a textbook case of narrative-driven momentum. The stock surged roughly 20%—to be more exact, it saw a peak intraday gain of 22.6% on Wednesday—before settling. This wasn't random volatility. The ascent was fueled by two potent catalysts: a landmark 6 GW deployment program with the Tennessee Valley Authority (TVA) and, concurrently, the U.S. Army’s announcement of its "Janus Program" to deploy nuclear microreactors at military bases.

On the surface, the logic is impeccable. NuScale holds the distinction of having the only small modular reactor (SMR) design approved by the U.S. Nuclear Regulatory Commission. With the TVA deal being touted as the largest SMR project in American history and the Pentagon now signaling serious intent to adopt similar technology for energy security, the company appears perfectly positioned at the nexus of decarbonization and national defense. The market, smelling a first-mover advantage in a sector with immense government tailwinds, responded by aggressively pricing in a decade of success. But my analysis of the underlying data reveals a significant disconnect between this euphoric narrative and the more sobering signals coming from those with the most at stake.

Let's first acknowledge the bull case, because it is compelling. The TVA agreement is a monumental validator for SMR technology. The plan to deploy up to six 77 MWe modules is a multi-billion dollar signal that a major utility sees this as a viable path to providing carbon-free baseload power, specifically for energy-hungry clients like AI data centers. Add to that the Army’s Project Janus, which intends to have an operational microreactor on a base by 2028. Because these reactors will be commercially owned and operated, NuScale is the obvious domestic front-runner. This isn't just hype; it's a tangible addressable market materializing in real time.

But while the market was cheering, another dataset was being generated, one that tells a very different story. Fluor Corp., NuScale’s majority shareholder and the engineering giant that helped take it public, was in the final stages of a massive share sale. Over a period of weeks, Fluor liquidated 15 million shares of Class A common stock, netting $605 million. The final tranche of this sale occurred on October 8th, just days before the stock’s explosive rally.

The official line, as is common in these situations, is that this is a routine strategic move. For those asking Why Is NuScale Power Stock Blasting Higher?, a "Foolish take" suggested shareholders "shouldn't read anything into this," noting Fluor was simply taking some profits after its investment quadrupled and still retains a 39% equity stake through Class B shares. I've looked at hundreds of these filings, and this is the part of the report that I find genuinely puzzling. While profit-taking is normal, the scale and timing here are critical. An entity with the deepest possible insight into NuScale's operations and pipeline chose to systematically reduce its most liquid holdings right at the cusp of what bulls claim is the company's breakout moment. Why cash out for an average price around $40.57 per share if you believe the stock is fundamentally worth the $55 it would hit just a week later? It represents an asymmetry of conviction. The market is screaming "buy," but the most informed investor's actions are whispering "sell."

This brings us to the numbers that underpin the entire debate: valuation. NuScale is a pre-revenue company in the truest sense; its first commercial plant isn't targeted for operation until around 2030, and the company is currently burning through approximately $95 million in cash per quarter. History provides a necessary dose of caution here, as NuScale’s flagship Idaho project was canceled in 2023 after projected costs nearly doubled. Execution risk in the nuclear space is not a theoretical concern; it's a historical constant.

Yet, at its recent peak, NuScale was trading at a forward price-to-sales ratio of nearly 85x. That is not a typo. For context, GE Vernova, a diversified energy giant also competing in the SMR space with its BWRX-300 reactor, trades at a forward P/S of about 4x. This is an extraordinary premium for a company whose primary product is still years from generating income, leading many to ask: NuScale Stock Skyrockets on Historic SMR Deal – Can GE Vernova Catch Up in the Nuclear Boom?

Wall Street analysts seem to agree. The consensus rating on SMR is a "Hold," with a median 12-month price target hovering in the $38 to $42 range. This isn't a bearish call, but it is a clear signal from the analyst community that the current stock price has detached from near-term fundamentals. They are essentially stating that the stock is overvalued by about 30%, even after factoring in the positive news from the TVA and the Army. The market has priced in not just the successful execution of the TVA project (which is still a deployment program, not a firm purchase order) but a flawless rollout of SMR technology for the rest of the decade. It's a price that leaves no room for the inevitable delays, cost overruns, and regulatory hurdles that accompany first-of-a-kind energy projects.

My conclusion is this: the market is not trading the NuScale of today, or even the NuScale of 2028. It is trading the idea of NuScale in 2035—a world where SMRs are a ubiquitous, profitable solution for the globe's clean energy needs. The narrative is powerful, and the long-term potential is undeniable. But the current valuation reflects a complete disregard for the immense operational and financial risks that lie between now and then.

Fluor’s decision to sell $605 million worth of stock is the most salient data point in this entire episode. It suggests that while the story is excellent, the price was better. For investors, the question isn't whether NuScale will be a pivotal company in the future energy landscape. The question is what price is reasonable to pay today for that uncertain, distant promise. Right now, the market is paying a steep premium, while the inside money has already started cashing the check.