An asset doesn’t just surge over 500% in a month without a story. In the case of Zcash (ZEC), the recent run from a quiet low of $54 to a peak of $374.4 is a masterclass in crypto narrative mechanics. On the surface, the catalysts are clean and textbook: a major digital asset manager, Grayscale, opens a door for institutional exposure; a pre-programmed "halving" event promises a supply shock; and a broader market rotation into privacy-centric tokens provides a rising tide.

The financial media loves this kind of story. It’s simple, exciting, and fits a pattern. We saw the predictions market Myriad resolve a public bet that Zcash would hit $369, a perfect little feedback loop of speculation begetting reality. We saw viral price calls, like Arthur Hayes’s $10,000 target, circulate through social media, stoking the retail engine. The price of Zcash wasn’t just a number on a screen; it was a scoreboard for a game of momentum and belief. But I've learned that in markets, the most compelling stories are often the most misleading. When the noise is this loud, my first instinct is to look for the signal in the data—or, more often than not, the lack of it.

Let's be clear: the forces driving the initial Zcash price movement are tangible. The halving, scheduled for November 18, is a known quantity. By cutting the miner block reward from 3.125 ZEC to 1.5625 ZEC, the event constricts the flow of new supply. This is Econ 101, and it’s a narrative that has historically been very profitable for assets like Bitcoin. Add the Grayscale effect, which provides a regulated, if indirect, way for larger pools of capital to gain exposure, and you have a potent combination for a rally.

This combination of supply-side shock and demand-side access is like building a high-performance engine for a race car. The halving tightens the fuel line, ensuring every drop is more precious, while Grayscale opens the throttle, letting more power flow in. It’s a powerful setup, and it explains the initial liftoff perfectly. The gains in other privacy assets like Monero and Dash, which rose 9.1% and 12.5% respectively in a week, suggest a sector-wide tailwind. Investors were clearly looking for a new theme, and privacy, an evergreen crypto-anarchist ideal, was back in vogue.

The problem arises when you look past the engine and check the tires. An engine can roar all it wants, but if the vehicle isn't actually moving forward in a meaningful way, you're just burning fuel and making noise. The price action was undeniable. The asset cleared its 2021 peak of $319 with ease, a move that prompted reports that Zcash Surpasses 2021 Peak as Traders Bet on Privacy Revival. But what fundamental activity was underpinning this explosive growth? Was the Zcash network itself seeing a commensurate boom in its core function?

This is the part of the analysis that I find genuinely troubling. The story being told by the price chart and the story being told by the on-chain data appear to be two entirely different narratives. And in my experience, when those two stories diverge, the on-chain data eventually wins.

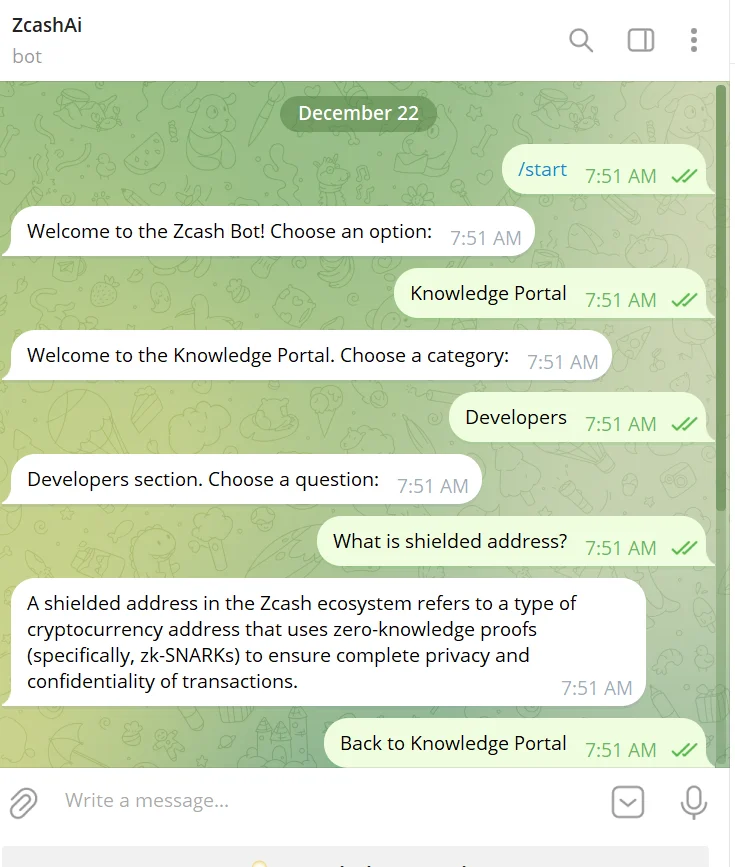

Zcash’s entire reason for being is privacy. Its unique selling proposition is the "shielded transaction," a cryptographic method that allows users to transact without revealing the sender, receiver, or amount. This isn't a secondary feature; it's the project's soul. If Zcash is succeeding, if it is achieving its stated mission, we should expect to see growth in the use of this core technology.

Yet, according to Shivam Thakral, the CEO of exchange BuyUCoin, that growth is conspicuously absent. He stated the rally was driven more by raw speculation than any fundamental uptick, pointing directly to a lack of significant increase in shielded transactions. This is a critical data point that cuts through the entire speculative narrative. The price of ZEC increased by more than 500%—to be more precise, a 592% gain from its 30-day low—while the primary utility metric of its network apparently flatlined.

What does this tell us? It suggests the overwhelming majority of the recent activity was not from users seeking financial privacy. Instead, it was from traders and speculators buying `ZEC Zcash` on exchanges like Coinbase, treating it as a purely speculative vehicle. They weren’t buying into the vision of a private, decentralized financial system; they were buying a ticker symbol attached to a compelling short-term story. This isn’t adoption. It’s a liquidity event.

This raises some uncomfortable questions. Is the Grayscale product merely a more efficient way for speculators to place their bets, rather than a sign of genuine institutional belief in the long-term utility of private digital cash? If the halving narrative is so powerful, why isn't it inspiring more people to actually use the network's key feature? Without a corresponding rise in shielded transactions, the rally feels hollow, like a beautiful, towering skyscraper built on a foundation of sand. We can admire the architecture, but we shouldn't be surprised when it starts to lean.

Perhaps the most sobering piece of data is the simplest. Despite this monumental rally, Zcash remains catastrophically down from its all-time high. According to CoinGecko, ZEC is still languishing 88% below its peak. Its all-time high was a staggering $3,191.93 (set nearly nine years ago on October 29, 2016). A move to $374 is a spectacular trade for anyone who bought at $54, but for a long-term holder, it's a rounding error on a catastrophic loss.

This context is crucial. Unlike `Bitcoin`, which has repeatedly broken its previous all-time highs and established itself as a macro asset, Zcash has, so far, failed to recapture its former glory. This history suggests a pattern of intense, hype-driven bubbles followed by prolonged and devastating drawdowns. The current rally, when viewed through this historical lens, looks less like the beginning of a new paradigm and more like a familiar echo.

The endorsements from respected figures like Naval Ravikanth and Mert Mumtaz certainly lend credibility, but they don't change the on-chain data. The core discrepancy remains: a price fueled by narrative and speculation, and a utility metric that suggests the narrative is just that—a story. The crypto market is, and always has been, a battle between narrative and reality. For one brief, shining month, the Zcash narrative was winning by a landslide. The question now is how long it can defy the gravity of its own fundamentals.

Let’s call this what it is: a purely speculative event, not a fundamental re-rating. The recent Zcash rally was a textbook case of a narrative-driven asset catching fire in a market hungry for the next big thing. The halving and the Grayscale listing were the matches, but the fuel was pure speculation, with little to no evidence of a corresponding increase in the network's core utility. The price action was the noise—deafening, exciting, and ultimately distracting. The signal, found in the stagnant use of its privacy features, tells a much quieter and more cautionary tale. This wasn't a comeback; it was an echo.