The headlines from Friday, October 3rd, 2025, paint a picture of serene strength. The Dow Jones climbed 239 points, the S&P 500 eked out its sixth straight day of gains for a "perfect week," and both indexes notched fresh closing highs. On the surface, it’s the kind of tape that breeds complacency. Wall Street, it seems, can shrug off anything, even a `federal government shutdown 2025` now entering its third day.

But beneath this placid surface, the data is telling a profoundly different story. My analysis suggests the `u.s. stock market today` isn't celebrating strength; it's exhibiting a classic late-cycle behavior of ignoring increasingly dire signals. The market is like a ship sailing under a small patch of blue sky, with the crew celebrating on deck while ignoring the ominous storm clouds gathering on every horizon. The current rally isn't a sign of a healthy economy. It's a symptom of a dangerous disconnect from reality.

The core of the problem is a data vacuum, conveniently created by the very shutdown the market is ignoring. With government agencies shuttered, the official September `jobs report unemployment` data—arguably the single most important monthly economic release—was never published. Investors are flying blind. And what happens when the primary navigation system goes offline? You’re forced to rely on secondary instruments. Unfortunately, every single one of those instruments is flashing red.

Let's be clear about the information that did manage to trickle out this week. The ADP private payrolls report, which measures jobs in the private sector, showed a loss of 32,000 positions in September. While traders often discount ADP in favor of the official Bureau of Labor Statistics number, a negative print is a significant outlier that shouldn't be dismissed. It suggests the labor market, the bedrock of the U.S. consumer economy, is not just cooling but actively contracting.

Then there’s the Institute for Supply Management’s services sector survey. It fell to a reading of 50.0. For anyone who tracks this data, that number is a klaxon horn. A reading above 50 indicates expansion; below 50 signals contraction. A reading of exactly 50 (down from 52, where it was expected to hold) means the services economy has ground to a complete halt. It’s stagnation. As Bill Adams, chief economist at Comerica Bank, noted, the survey showed that a majority of respondents were already trimming their headcount.

This brings me to a methodological critique I often have in moments like these: how can the market price in future growth when the most reliable forward-looking indicators are pointing toward a recession? Is the collective wisdom of the market truly wise, or is it just momentum-chasing algorithms ignoring the fundamentals? The absence of the official jobs report has created a narrative void, and it appears that bullish inertia has rushed in to fill it.

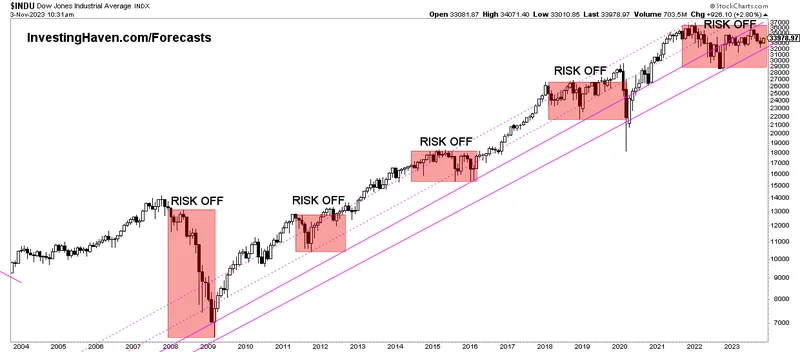

I've looked at hundreds of market cycles, and this particular pattern—record highs concurrent with a data blackout and deteriorating secondary indicators—is a classic setup for a sharp reversal. The market is pricing in a perfect landing based on hope, while the available data is sketching out a stall. The discrepancy is jarring.

The illusion of strength becomes even more apparent when you look past the index level and into the performance of individual companies. The S&P 500 may be up roughly 15% over the past year, but that performance is not evenly distributed. It's a story of bifurcation.

Consider Target. The retail giant, a bellwether for American consumer health, has seen its stock plummet by 40% over the same period the index has been soaring. In its second quarter, sales fell 0.9%—to be more exact, same-store sales were off by 1.9%. While analysts might frame this as a "The Stock Market Is Historically Pricey: Here's 1 Reason Target Is Still a No-Brainer Buy," the raw numbers point to a consumer who is pulling back. You cannot have a healthy, broad-based economic expansion when a company like Target is in a deep bear market. It’s a mathematical and logical impossibility.

This isn't just an "old economy" problem, either. The Nasdaq, the engine of the market's growth, actually snapped its winning streak on Friday, dipping 0.3%. The pullback was led by some of the very high-flying tech stocks, like Tesla and Palantir, that have been responsible for so much of the index's gains. This suggests that even the market's narrow leadership is beginning to wobble.

What does this tell us? The market's "perfect week" wasn't a reflection of a powerful, all-encompassing bull run. It was a statistical anomaly, an outcome of a few mega-cap stocks dragging the weighted index higher while a significant portion of the market languishes or declines. This is a fragile foundation upon which to build all-time highs. When will the weight of the struggling majority finally pull the high-flying minority back to earth?

My conclusion from the data is clinical and direct: the current market strength is an illusion. It is a rally driven by the absence of bad news, not the presence of good news. Investors are ignoring the private sector data that screams "slowdown" and are instead clinging to price momentum. The government shutdown has inadvertently created a smokescreen, delaying the inevitable confirmation from the official jobs report that the economy is weaker than the `dow jones stock markets today` would have you believe. The divergence between a handful of soaring tech names and struggling consumer staples like Target isn't a sign of a dynamic economy; it's the signature of a market top. This isn't strength. It's inertia before a fall.